A Deep Dive into ByBit: A Leading Crypto Exchange

Cryptocurrency trading has surged in popularity over the past few years, bringing forth several exchanges aiming to facilitate these digital transactions. Among them, ByBit has risen as a prominent player. This article shines a light on ByBit, its key features, and what sets it apart in the bustling world of crypto exchanges.

Introduction to ByBit

Established in March 2018, ByBit is a global cryptocurrency derivatives exchange. Unlike many traditional exchanges which facilitate spot trading (direct buying and selling of cryptocurrencies), ByBit specializes in derivatives trading, allowing users to trade cryptocurrency contracts backed by mainstream digital assets.

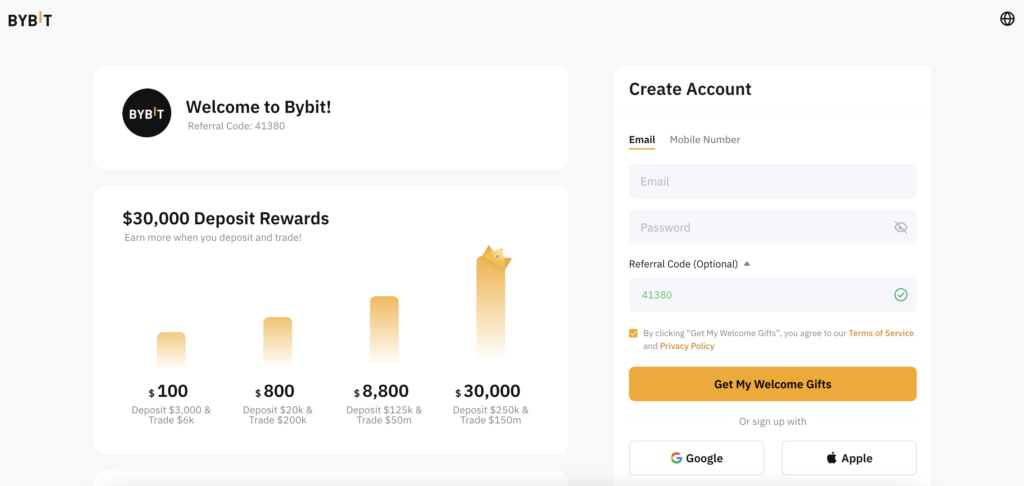

By using our referral link to ByBit you can get up to $30,000 Deposit Rewards!

After clicking on it, you’ll be prompted to register using your email or mobile number, followed by creating a password. Once you’ve verified your account—typically through a confirmation link sent to your email—you’re officially part of the ByBit community!

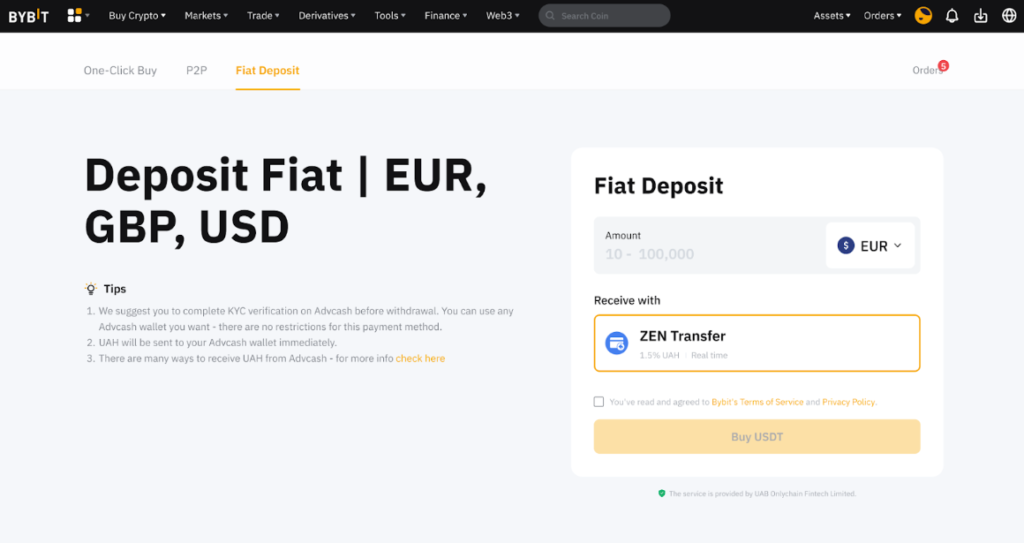

With your account set up, it’s time to add funds. Go to the ‘Wallets’ or ‘Funds’ section, and you should see an option for fiat deposits. In order to deposit fiat into your Bybit account, please go to the Buy Crypto –> Fiat Deposit page.

ByBit usually supports various methods like bank transfers, credit cards, or third-party payment processors. Choose your preferred method, follow the on-screen instructions, and transfer the amount you wish to deposit. Remember, there might be a small fee associated with fiat deposits, so it’s wise to check the terms before proceeding.

Now, why would you want to change your fiat deposit into USDT? USDT, or Tether, is a stablecoin, meaning its value is pegged to a stable asset like the US dollar. This pegging makes USDT less volatile compared to other cryptocurrencies. By holding USDT, you essentially have a digital representation of USD. On ByBit, navigate to the ‘Exchange’ or ‘Trade’ section. There, you can choose a pair like USD/USDT and buy USDT with the dollars you deposited.

With your USDT in hand, it’s time to explore the world of cryptocurrencies. Head over to the ‘SPOT’ trading section of ByBit. Here, you’ll see various trading pairs like BTC/USDT or ETH/USDT. Choose the cryptocurrency you’re interested in, for example, Bitcoin or Ethereum, input the amount you wish to purchase, and confirm your order. In moments, you’ll own a piece of the ever-evolving crypto universe.

How to Trade Crypto on ByBit

Trading cryptocurrencies on ByBit can seem intimidating at first, but with a bit of guidance, you can navigate the platform with ease.

Here’s a comprehensive breakdown to get you started:

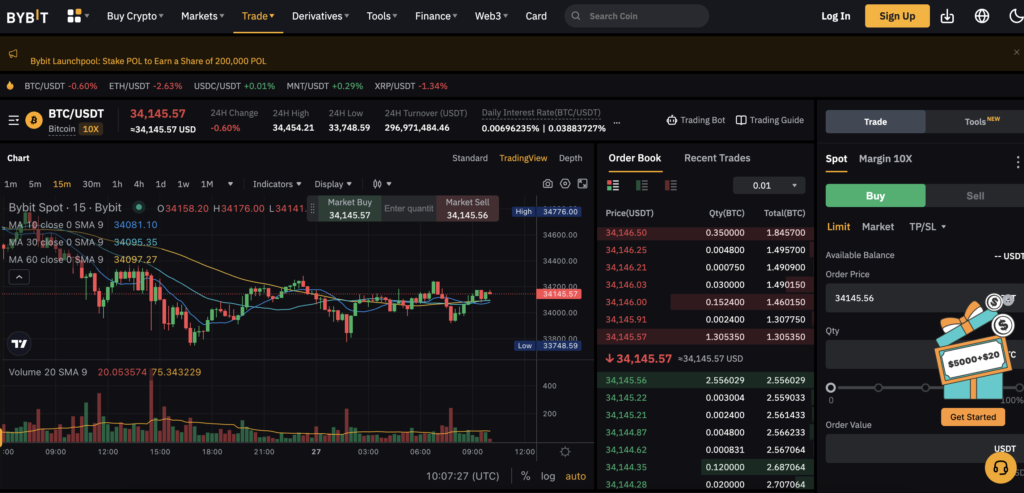

1. Log In & Navigate to the Trading Platform: After logging into your ByBit account, head to the top navigation bar and click on the ‘Trade’ option. This will direct you to the trading platform, showcasing a variety of information: price charts, order books, recent trades, and the order placement section.

2. Choose Your Trading Pair: On the top-left corner, you’ll find a dropdown menu displaying available trading pairs, such as BTC/USDT, ETH/USDT, and many others. Select the pair you’re interested in. For instance, if you want to trade Bitcoin using your USDT, select BTC/USDT.

3. Analyze the Market: Before making a trade, it’s crucial to understand the market direction. Use the interactive price chart in the center of the screen to view historical and real-time price data. Tools and indicators, such as Moving Averages or RSI, can be added to help with your analysis.

4. Place Your Order: Below the price chart, you’ll find the order placement section. Here, you can select the type of order you want to place:

- Market Order: This allows you to buy or sell instantly at the current market price.

- Limit Order: With this, you set a specific price at which you want to buy or sell. The order will only execute when the market price matches your set price.

- Stop Order: This acts as a trigger; when the market hits a specific price (the stop price), a market order is automatically placed.

Input the amount of cryptocurrency you wish to buy or sell and confirm the details. If you’re placing a limit or stop order, ensure you set your desired price.

5. Confirm & Monitor Your Trades: Once you’re satisfied with your order details, click on the ‘Buy’ or ‘Sell’ button. Your order will then appear in the ‘Open Orders’ section until it’s filled. After execution, you can find the details in the ‘Order History’ section.

6. Setting Stop-Loss or Take-Profit: It’s wise to use features like stop-loss or take-profit to manage potential losses or secure profits. These can be set during the order placement process or added afterward by editing an open order.

7. Stay Updated & Adapt: Cryptocurrency markets can be highly volatile. Stay updated with market news, continually monitor your trades, and be ready to adapt your strategies as needed.

Remember, while the mechanics of trading might be simple to grasp, successful trading requires research, patience, and a keen understanding of the market. Always trade responsibly, and consider starting with a demo account or trading small amounts until you’re more comfortable.

Spot vs. Futures: Understanding the Differences

In the realm of cryptocurrency trading, two dominant trading methods are Spot and Futures trading. Both come with their unique features, benefits, and risks. Here’s a breakdown to help you distinguish between the two:

Spot Trading

- Definition: Spot trading refers to the purchase or sale of a financial instrument, like a cryptocurrency, for immediate delivery and settlement. Essentially, when you buy a cryptocurrency on a spot market, you immediately own that asset and can transfer or use it as you wish.

- Settlement: Transactions are settled “on the spot,” typically within a few days of the trade.

- Ownership: When you buy a cryptocurrency in the spot market, you directly own the underlying asset. This means you can transfer it to your personal wallet, use it for transactions, or simply hold it.

- Leverage: Spot trading often doesn’t offer the high leverage seen in futures trading, meaning you’re trading primarily with your capital. However, some platforms may provide minor leverage for spot trades.

- Risk & Reward: While the value of your asset can rise or fall, you won’t face liquidation (a complete loss) like in futures trading. Your potential loss is limited to the amount you invested.

Futures Trading

- Definition: Futures trading involves buying or selling a financial contract (called a futures contract) that obligates the buyer to purchase, and the seller to sell, an asset at a predetermined date and price in the future.

- Settlement: Futures contracts have a specified expiration date when the contract must be fulfilled. Some traders close out their positions before this date, while others hold until settlement.

- Ownership: You do not own the underlying asset when trading futures. Instead, you’re speculating on its future price. This means you can’t withdraw the cryptocurrency to your personal wallet.

- Leverage: One of the hallmarks of futures trading is the use of leverage. This means you can open positions much larger than your account balance. While this can amplify profits, it also magnifies potential losses.

- Risk & Reward: Due to the leveraged nature of futures, potential profits and losses can be significant. It’s possible to lose more than your initial margin, and if your account balance doesn’t cover potential losses, your position can be liquidated by the platform.

Which to Choose?

The decision between spot and futures trading largely depends on your investment goals, risk tolerance, and trading expertise. Spot trading is often recommended for beginners and those who want to hold onto their cryptocurrency assets. On the other hand, futures trading can be suitable for experienced traders looking to hedge or leverage their positions for greater potential returns, while being aware of the heightened risks involved.

Always remember to do thorough research and possibly consult with financial professionals before diving into any trading strategy.

Key Features of ByBit

- Robust Security Protocols:

- ByBit emphasizes a multi-tiered, multi-cluster system architecture. It incorporates industry-leading security features such as cold wallet storage, two-factor authentication (2FA), and withdrawal whitelist to enhance platform security and protect user assets.

- High Liquidity:

- Offering swift order execution with minimal spread and slippage, ByBit ensures high liquidity, a key factor for traders who wish to enter or exit positions without significant price fluctuations.

- Leveraged Trading:

- ByBit provides users with leverage up to 100x, enabling traders to amplify their potential profits. It’s worth noting, however, that while leverage can increase profits, it can also magnify losses.

- Intuitive User Interface:

- Catering to both beginners and seasoned traders, ByBit’s platform boasts a user-friendly interface. It offers an intuitive dashboard, advanced charting tools, and an easy-to-navigate mobile app.

- 24/7 Customer Support:

- Understanding the need for swift assistance in the fast-paced crypto world, ByBit offers 24/7 customer support, ensuring users receive timely assistance for their queries or concerns.

- Mutual Insurance Fund:

- A unique feature of ByBit, the Mutual Insurance fund provides a safety net for traders. It allows them to purchase insurance to protect their positions and limit potential losses.

- Trading Competitions:

- Periodically, ByBit hosts trading competitions, where traders from around the world compete for lucrative prizes. These contests not only provide an avenue for traders to showcase their skills but also to learn from the strategies of other participants.

- Fiat Gateway:

- ByBit has integrated fiat gateways into its platform, allowing users to purchase cryptocurrencies using traditional fiat methods. This seamless integration makes the transition from fiat to crypto smoother for many users.

Why Choose ByBit?

- Transparency: ByBit maintains a commitment to transparency. The platform regularly updates its users about system upgrades, potential issues, or any significant events via official channels.

- Educational Resources: Recognizing the complexities of crypto trading, ByBit offers a suite of educational resources, tutorials, and articles aimed at helping users understand the intricacies of the crypto world.

- Advanced Trading Tools: For those seeking advanced trading strategies, ByBit provides a plethora of tools, including a range of order types, risk management tools, and more.

- Global Presence: ByBit’s platform supports multiple languages and serves traders globally, emphasizing its commitment to being an inclusive and international exchange.

In Conclusion

ByBit has rapidly emerged as a trusted name in the cryptocurrency derivatives trading realm. Its emphasis on security, user experience, and continuous improvement has garnered it a substantial user base. While the world of crypto trading can seem intricate, platforms like ByBit are making strides in ensuring that traders, whether novices or experts, have the tools and resources they need to navigate the crypto seas successfully.

As always, while ByBit offers many advantages, prospective users should conduct their research and possibly consult financial advisors before diving into crypto trading, ensuring they make informed decisions.

P.S. the above links are affiliate.

Leave a Reply