In the ever-evolving space of blockchain technology and cryptocurrencies, the catastrophic fall of Terra Luna serves as a stark reminder of the volatility and uncertainty inherent in these digital assets. This article delves into the crux of the disaster, analyzing the factors that contributed to the fall of Terra Luna and its algorithmic stablecoin, UST.

Prelude to a Disaster

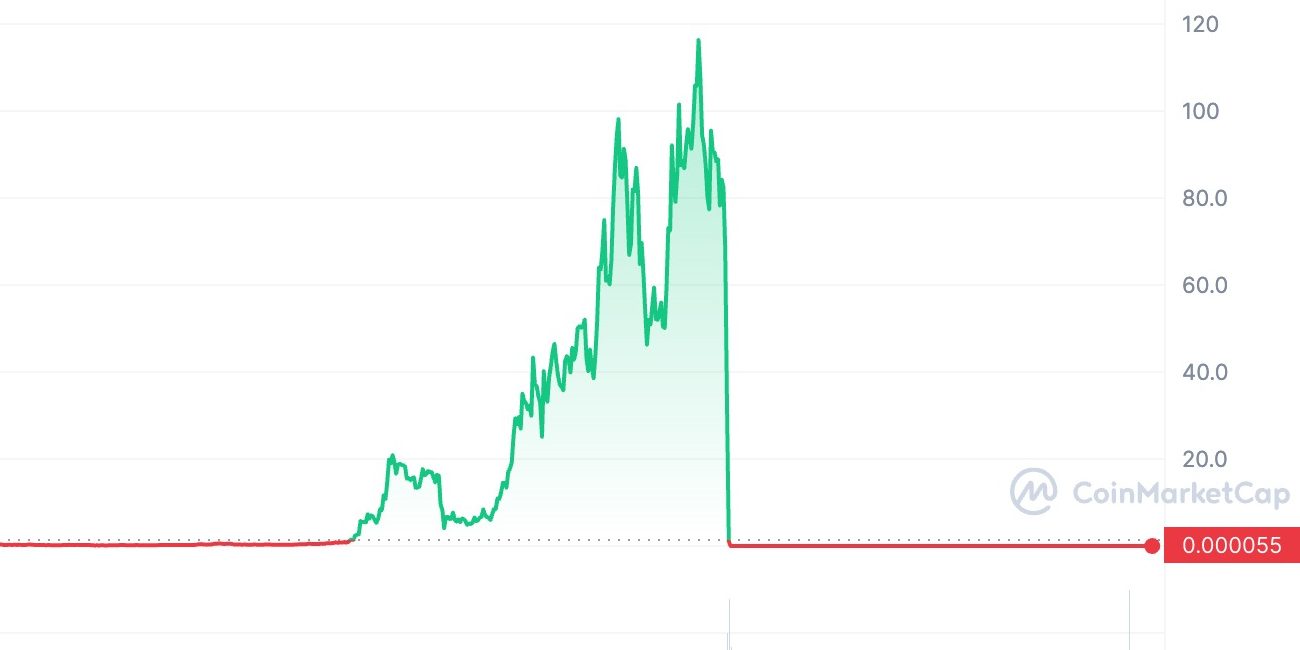

The Terra network, founded by Do Kwon and Daniel Shin of Terraform Labs, soared to prominence in the crypto realm in a short span of four years, only to witness a disastrous fallout that sent ripples across the global digital currency market. Terra Luna, the native token of the Terra blockchain, enjoyed a meteoric rise, with its value surging from less than $1 in early 2021 to a staggering $119 in April 2022, only to plummet to a fraction of a cent post-collapse.

The Fall of UST and Terra Luna

The catastrophe unfurled when the ecosystem’s stablecoin, UST, got de-pegged from its $1 parity, triggering a massive sell-off. Terraform Labs, desperate to stabilize UST, liquidated their entire 40,000 BTC holdings, further exacerbating the market crash as Bitcoin’s price tumbled below $27,000 for the first time since December 2020. The repercussions were severe: the algorithmic stablecoin UST and Luna coin experienced a catastrophic loss in value, resulting in a liquidity crisis in the cryptocurrency space.

This substantial sell-off exerted downward pressure on the UST token’s price, causing it to plummet to $0.91. Consequently, individuals began acquiring LUNA tokens in response to this development.

You can see this death spiral crash of LUNA on this chart.

It was all so sudden and the exact reasons for Luna crash are still unknown.

The Illusion of Stability

Terra Luna and UST’s story brings forth the vulnerability of algorithmic stablecoins, which, unlike their collateral-backed counterparts, are susceptible to drastic fluctuations. The stability of UST was based on algorithms tied to Luna’s valuation, a mechanism that crumbled as Luna’s price plummeted, dragging UST down with it.

The Aftermath

The aftermath of the crash was not only a financial loss but a harsh lesson in the volatile nature of cryptocurrencies. The crash left Terra Luna Classic (LUNC) and UST trading at a mere fraction of their former values. The event also raised questions about the manipulation of blockchain networks and the risks associated with investing in relatively new, untested cryptocurrency networks.

The Hard Fork: LUNA 2.0

In an attempt to salvage the network, a hard fork was executed on May 28, 2022, birthing Terra Luna 2.0. However, this move couldn’t restore investors’ confidence entirely, as the price of the new LUNA remained volatile, reflecting the uncertainty surrounding its underlying value post hard-fork.

Currently we have Luna and Luna Classic. Luna Classic LUNC is the original Luna, still ranked in the first 100 top crypto coins. Luna or Terra Luna is the hard fork. Luna 2.0.

Future of Luna

The Terra Luna debacle underscores the importance of robust mechanisms to ensure stability, especially in the realm of algorithmic stablecoins. It also calls for a nuanced understanding and a cautious approach towards investing in cryptocurrencies, bearing in mind the inherent risks and the potential for severe financial repercussions.

In retrospect, the fall of Terra Luna and UST serves as a poignant lesson in the annals of crypto economics, urging investors and stakeholders to tread with caution in the labyrinth of digital assets.

However there are also positive sides to the story. The community of Luna fans, or Lunatics, came together to keep on building. They keep on adding new features to Luna and Luna Classic blockchains that you can see on their social media.

If you are undeterred by this crash of Luna and want to join the ecosystem, you can buy LUNA crypto as well as LUNC Luna Classic on multiple exchanges (look for LUNA or LUNC tickers):

All these exchanges allow you to buy and hold both Luna and Luna Classic crypto coins.

P.S. None of this is financial advice! The links above are affiliate.

Leave a Reply