The new generation of Decentralized Futures Exchanges is here: fast, great UI, CEX like features. The top 3 DEXs by features and volume are RabbitX, Vertex Protocol and Hyperliquid. Let’s compare them directly.

For each exchange we offer special referral links that will give you bonus after registration:

Let’s now get into direct comparison of these decentralized futures crypto exchanges.

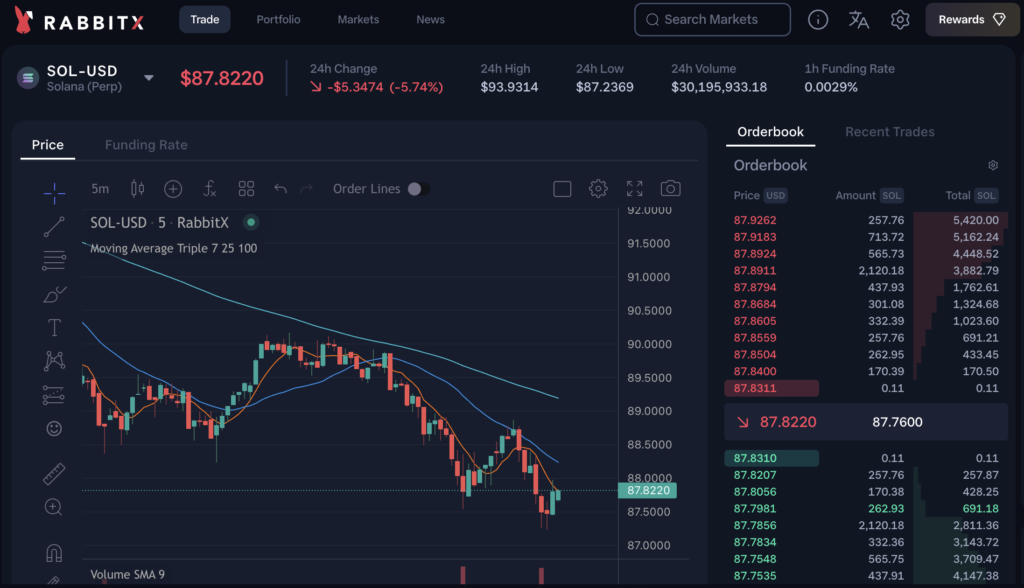

1. RabbitX

- Type: Global permissionless perpetuals and derivatives exchange.

- Features: Offers zero gas fees, up to 20x leverage, order book liquidity, 24/7 customer support, and access to global markets including stocks, FX, and commodities. It uses Starknet technology for low-latency and high-security transactions.

- Security: Built on Ethereum, incorporating ZK-STARK technology for enhanced security.

- User Interface: Trader-focused with milliseconds latency.

- Unique Aspects: Known for high speed and innovative derivatives offerings, RabbitX is rebuilding a better financial system focusing on price transparency and automated clearing for derivatives trading.

- Tokenomics: Uses RBX tokens with a supply of 1 billion, allocated across various activities including trading rewards and liquidity mining.

2. Vertex Protocol

- Type: Cross-margined decentralized exchange offering spot, perpetuals, and integrated money markets.

- Features: Unique blend of Central Limit Order Book (CLOB) and Automated Market Maker (AMM) systems. Offers up to 10x leverage on perpetual contracts and spot trading against USDC.

- Security: Non-custodial, self-custodial system with open-source contracts and comprehensive code audits.

- User Interface: Streamlined, customizable trading interface akin to popular CEX interfaces.

- Unique Aspects: Combines the benefits of decentralized trading with the performance of centralized platforms, boasting extremely low-latency trading and effective liquidity utilization.

- Tokenomics: Uses VRTX tokens for incentivizing participation and contribution, with a fixed supply of 1 billion tokens.

3. Hyperliquid

- Type: Decentralized perpetual exchange.

- Features: Advanced order types, up to 50x leverage, and integration with TradingView for order modification and cancellation.

- Security: Focuses on blockchain-based security, being a decentralized platform.

- User Interface: Seamless trading with one-click trading and no interruptions for wallet approvals.

- Unique Aspects: Combines CEX features in a decentralized environment, fast transactions (less than 1 second), and transparent, fully on-chain order books.

- Tokenomics: Hyperliquid does not have a token yet. There’s a potential crypto airdrop that might come to active traders on the platform later on in 2024.

Futures Crypto Exchange to Choose in 2024

Here’s a summarized comparison of RabbitX, Vertex Protocol, and Hyperliquid in a table format:

| Feature | RabbitX | Vertex Protocol | Hyperliquid |

|---|---|---|---|

| Type | Global permissionless perpetuals and derivatives exchange | Cross-margined DEX offering spot, perpetuals, and integrated money markets | Decentralized perpetual exchange |

| Key Features | Zero gas fees, up to 20x leverage, global market access, Starknet technology | CLOB and AMM systems, up to 10x leverage, spot trading against USDC | Advanced order types, up to 50x leverage, TradingView integration |

| Security | Built on Ethereum with ZK-STARK technology | Non-custodial, self-custodial system, open-source contracts, code audits | Blockchain-based security |

| User Interface | Trader-focused, milliseconds latency | Customizable trading interface similar to CEX interfaces | Seamless, one-click trading |

| Unique Aspects | High-speed trading, innovative derivatives offerings | Low-latency trading, efficient liquidity utilization | CEX features in a decentralized environment, fast transactions |

| Tokenomics | Uses RBX tokens, 1 billion total supply | Uses VRTX tokens, 1 billion fixed supply | Potential crypto airdrop coming in 2024 |

This table provides a concise overview of the major differences and unique selling points of each exchange, helping to compare their features, security measures, user interfaces, and other key aspects.

Each of these exchanges brings unique strengths to the table. RabbitX is notable for its speed and zero gas fees, Vertex Protocol for its innovative blend of CLOB and AMM systems, and Hyperliquid for its blend of centralized exchange features in a decentralized setting. These platforms are reshaping the landscape of crypto trading, offering traders a range of tools and features tailored to various trading strategies and preferences.

Last but not least, because they are new, they are trying to attract users by providing various incentives to traders.

P.S. the above links are affiliate. Nothing here is financial advice, crypto is risky.

Leave a Reply