In the ever-evolving realm of cryptocurrency, the Woo Network has emerged as a significant player. To understand its impact and offerings, it’s essential to delve into its history, development, and role in the broader crypto market.

The Woo Network’s journey began with a vision to democratize access to deep liquidity and low-cost trading in the crypto market. The platform, an innovative amalgamation of centralized finance (CeFi) and decentralized finance (DeFi) services, was designed to cater to a wide range of market participants, including individual traders, exchanges, institutions, and DeFi platforms.

Woo Network’s mission is to provide a gateway for seamless, efficient, and affordable trading experiences. This is achieved through its unique business model and strategic collaborations, notably with Kronos Research, a firm specializing in quantitative trading and hedging strategies. These partnerships have been pivotal in aggregating liquidity from an array of top centralized exchanges and DeFi networks, enhancing the platform’s appeal.

Woo Network’s influence extends beyond just offering trading services. It plays a crucial role in the broader crypto ecosystem by providing a platform for liquidity aggregation, market making, and a host of other financial services. This holistic approach positions Woo Network as a key player in shaping the future of cryptocurrency trading and investment.

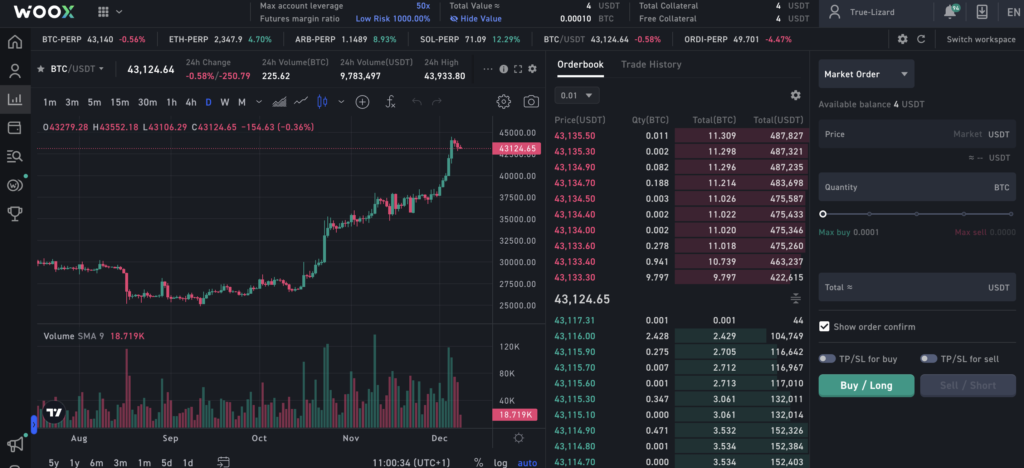

This text is a comprehensive guide to Woo Network. We’re going to cover everything from Woo origins to how to buy crypto on Woo. The most popular trading pair on the platform is BTC/USDT. WOO Network supports both spot and derivatives markets, providing a wide array of assets for trading. This includes 88 spot markets and 64 futures markets, offering traders a broad spectrum of options to choose from. When considering what to potentially buy first, it would be prudent to look at these popular markets, particularly the BTC/USDT pair, as a starting point. However, always remember that cryptocurrency investments come with risks, and it’s essential to conduct thorough research. Nothing here is financial advice.

We are VIP affiliate partners to WOO and you can use our special link to sign up to receive a potential bonus in crypto.

- Introduction to Woo Network

- How Woo Network Works

- Collaboration with Kronos Research

- Liquidity aggregation from centralized and DeFi platforms

- Clients’ connection methods (API, GUI on WOO X and WOOFi)

- Unique Features of Woo Network

- Financial and technical expertise of the team

- Overview of products: WOO Network, WOO X, WOOFi, WOO Ventures

- Zero-fee model and favorable terms towards taker orders

- WOO X: The Centralized Finance (CeFi) Trading Platform

- Low-fee trading and Tier systems

- Deep liquidity and its importance

- Customizable workspaces for traders

- WOOFi: Expanding Liquidity to DeFi

- Description of the Synthetic Proactive Market Making model

- Swapping, Earning, and Staking features

- The WOO Token

- Utility and functionality within the network

- Governance, staking, and yield distribution

- WOO token burn and its implications

- Trading and Investment Opportunities

- Spot and futures markets

- Liquidity pools and their benefits

- Crypto staking and interest earnings

- Security Measures

- Advanced security features and certifications

- User account protection strategies

- Global Reach and Restrictions

- Availability of Woo Network in different countries

- Restrictions for U.S. residents and other jurisdictions

- Conclusion

Chapter 1: Introduction to Woo Network

Welcome to the world of Woo Network, a dynamic platform for trading cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and many others. To begin your journey, you’ll first need to create an account on Woo Network. This process involves signing up with your email, setting a secure password, and completing the mandatory Know Your Customer (KYC) verification. Once your account is set up, you can start trading by depositing funds into your account. You can trade BTC and other coins by selecting the desired trading pairs, analyzing market trends, and executing trades. Remember, trading cryptocurrencies requires careful consideration of market risks and an understanding of the platform’s features.

Here’s a brief guide:

- Register on WOO X with out VIP referral code here.

- Select your nationality & region, enter your email address, create a strong password (a combination of numbers, letters, at least one upper case, and 9-20 characters), and enter a referral code if you have one.

- After submitting the information, a verification code will be sent to your email. Enter this code within 10 minutes to proceed.

- Once you input the verification code, your registration on WOO X will be complete.

Remember to read and agree to the Terms of Service during this process. After registration, you can start trading BTC and other cryptocurrencies by depositing funds and selecting your desired trading pairs on the platform.

Chapter 2: How Woo Network Works

The Collaboration with Kronos Research

A key aspect of Woo Network’s operational model is its collaboration with Kronos Research. This partnership is foundational to the network’s ability to aggregate and integrate liquidity. Kronos Research, known for its expertise in quantitative trading and hedging strategies, plays a crucial role in enhancing the network’s efficiency and reach. By pooling liquidity from leading centralized trading platforms and increasingly from DeFi networks, Woo Network ensures a rich and diverse liquidity pool.

Liquidity Aggregation: Centralized and DeFi Platforms

Woo Network’s approach to liquidity aggregation is multifaceted. It taps into resources from centralized platforms and DeFi networks such as Ethereum, BNB Chain, Polygon, and Avalanche. This aggregation is not just beneficial for the platform but also for its clients, who can connect directly via API or through the user interfaces on WOO X and WOOFi. The vast pool of liquidity also attracts market makers from other platforms, providing an ideal venue for low-cost hedging.

The Role of Market Makers

Market makers from various platforms, including dYdX, find Woo Network an attractive option for hedging exposure. This is due in part to the zero-fee model and favorable terms for taker orders. The platform’s growing trading volume, which reached a notable $2.5 billion in a 24-hour period in September 2021, is a testament to its expanding influence and the effectiveness of its liquidity aggregation strategies.

Chapter 3: Unique Features of Woo Network

The Expertise Behind the Network

Woo Network’s unique positioning in the crypto market is significantly influenced by the financial and technical expertise of its team. This team includes professionals with notable experience from major firms like Citadel, Virtu, Allston, Deutsche Bank, and BNP Paribas. This wealth of knowledge and experience plays a crucial role in shaping the network’s product offerings and strategic direction.

Product Offerings: A Diverse Array

- WOO Network: Primarily serves as a gateway for institutional clients, enhancing their order books to match the depth and competitiveness of top exchanges, and tightening their bid-ask spread.

- WOO X: This is a zero or negative fee trading platform designed for professional and institutional traders, offering unparalleled liquidity and execution. A standout feature of WOO X is its fully customizable modules, allowing users to tailor their workspace according to their trading preferences.

- WOOFi: Positioned as a suite of products expanding WOO Network’s liquidity to DeFi, WOOFi aims to provide DeFi users with optimal pricing, minimal fees, tight bid-ask spreads, and safe yet rewarding yield-generating opportunities.

- WOO Ventures: This is the investment arm of WOO Network. It focuses on forming strategic partnerships with projects and ecosystems, with 50% of the returns from these investments distributed back to WOO token holders.

The Zero-Fee Model and Its Benefits

A cornerstone of WOO Network’s appeal is its zero-fee or even negative fee trading model. This innovative approach is particularly beneficial for high-volume traders, offering a cost-effective trading environment. The focus on low-cost trading is further supported by the network’s deep liquidity, ensuring efficient order execution with minimal slippage.

Chapter 4: WOO X – The Centralized Finance (CeFi) Trading Platform

Low-Fee Trading and Tier System

WOO X, the primary CeFi service of Woo Network, is renowned for its low-fee trading structure. This aspect is crucial for traders in choosing a platform as it significantly impacts their trading costs. WOO X offers a unique Tier system that allows users to reduce their trading fees further. Attaining Tier 2 status, for instance, which is available to users staking 1800 WOO, results in even lower maker and taker fees, with occasional additional benefits.

Deep Liquidity: The Core of Efficient Trading

Deep liquidity is the backbone of any successful exchange. It ensures that buyers and sellers can complete their orders efficiently, with minimal slippage and narrow bid-ask spreads. WOO X excels in this area by sourcing liquidity from various entities, including traders on the platform, professional liquidity providers, other exchanges, and institutions. The significant contribution from Kronos Research as a liquidity provider enables WOO X to offer deep liquidity, attracting more users to the network.

Customizable Workspaces: Catering to Diverse Trading Needs

A key feature of WOO X that appeals particularly to experienced traders is its customizable trading interface. The platform allows users to personalize their trading view with various widgets, charts, and other elements tailored to their preferences. Additionally, the integration of advanced charting tools from TradingView empowers traders to create indicators for technical analysis, further enhancing the trading experience.

Chapter 5: WOOFi – Expanding Woo Network into DeFi

WOOFi: Bridging CeFi and DeFi

WOOFi represents a significant extension of Woo Network into the decentralized finance (DeFi) space. It is a Binance Smart Chain-based Automated Market Maker (AMM) that utilizes a unique Synthetic Proactive Market Making (sPMM) model. This model, in contrast to the classic Constant Product Market Maker (CPMM) approach used by typical AMMs, is designed to offer more efficient and market-aligned pricing.

The sPMM Model and Its Advantages

The sPMM model employed by WOOFi has closer similarities to traditional exchange order books than to AMMs like Uniswap on Ethereum (ETH). It uses WOO Network’s market data oracles to scan order book prices from centralized exchanges like Binance and calculate suitable trade prices. This innovative approach allows for better pricing and reduced slippage in trades.

Core Features of WOOFi

- Swapping: Users can swap between token pairs in WOOFi’s liquidity pools. The single pool liquidity model, as opposed to the traditional dual asset liquidity pool system, is managed and rebalanced by WOOFi to incentivize investment in lower liquidity assets.

- Earning: WOOFi allows users to deposit LP tokens from other DEXs and individual assets for yield farming. These vaults are designed to reinvest profits automatically and efficiently, compounding interest and maximizing returns for users.

- Staking: WOOFi also offers staking options for WOO token holders. Stakeholders share in the revenue generated from swapping and earning on WOOFi, creating an additional incentive for holding and using WOO tokens within the ecosystem.

Chapter 6: The WOO Token – Unifying Force of Woo Network’s Ecosystem

WOO Token: More Than Just a Cryptocurrency

The WOO token is the native cryptocurrency of Woo Network, serving as the central element unifying the various products and services offered across both its CeFi and DeFi platforms. With a maximum supply cap of 3 billion tokens, the WOO token is designed to decrease over time through monthly token burns until 50% of the supply is eliminated.

Multi-Blockchain Utility and Accessibility

WOO tokens are unique in their multi-blockchain presence, existing across various chains through bridges, including BNB Chain, Ethereum, Avalanche, Polygon, Solana, Arbitrum, Fantom, and NEAR. This wide accessibility is complemented by its integration within prominent decentralized exchanges (DEXes) like Bancor, SushiSwap, Uniswap, PancakeSwap, QuickSwap, and SpookySwap.

The Diverse Use Cases of WOO Token

- Governance: Holders of WOO tokens can participate in decentralized governance, contributing to decision-making processes by creating proposals or voting within the WOO DAO (Decentralized Autonomous Organization).

- Staking: Staking WOO tokens provides benefits such as reduced trading fees and zero-fee trading on WOO X. High-volume traders can also stake WOO to enhance their trading limits and enjoy further fee reductions.

- Yield Distribution: WOO Ventures distributes a portion of its investment returns to WOO token stakers, adding an investment return aspect to holding the token.

- Liquidity and Yield Farming: The token can be used in liquidity pools and farms across multiple blockchains, offering various opportunities for yield generation.

- Lending and Borrowing: WOO tokens serve as collateral for crypto loans, broadening the utility of the token in financial transactions.

- Social Trading: Plans are in place for WOO stakers to emulate trading strategies from top-performing traders, further integrating the token into the trading ecosystem.

- Token Burn: In a bid to enhance the token’s value, Woo Network uses 50% of its platform revenue to buy back and burn WOO tokens every month.

Chapter 7: Trading and Investment Opportunities on Woo Network

Spot and Futures Markets: A Haven for Traders

Woo Network provides extensive trading opportunities through its spot and futures markets. These markets are designed to cater to a diverse range of trading strategies and preferences, whether users prefer the immediate settlement of spot trading or the advanced tactics possible in futures trading. The deep liquidity present in these markets ensures efficient order execution, making it an attractive platform for both casual and professional traders.

Liquidity Pools: Generating Passive Income

Liquidity pools on Woo Network are a vital feature, offering users the opportunity to provide liquidity in exchange for a share of transaction fees or other rewards. These pools typically consist of pairs of different cryptocurrencies, including stablecoins and popular assets like BTC. By participating in these liquidity pools, users can earn passive income, with some pools offering up to 16% annual percentage yield (APY).

Crypto Staking: Earning Interest on Holdings

Woo Network’s staking program allows users to stake their Woo tokens and earn interest. This feature not only provides an attractive rate of return but also offers additional benefits such as trading fee discounts on the Woo Network. Staking WOO tokens is straightforward and is an appealing option for users looking to maximize the utility of their holdings.

Educational Resources: Empowering Informed Decisions

To support its users, Woo Network offers a wealth of educational resources. These resources are designed to help users navigate the platform, understand the complexities of cryptocurrency trading, and make informed investment decisions. The presence of these educational tools demonstrates Woo Network’s commitment to user empowerment and responsible trading.

Chapter 8: Security Measures and Customer Support on Woo Network

Prioritizing User Security

The security of users’ funds and data is a paramount concern for Woo Network. To address this, the platform implements a range of advanced security measures. These include two-factor authentication (2FA) and anti-phishing codes, which provide an additional layer of security against unauthorized access and phishing attempts. Woo Network also maintains a rigorous protocol for its proof of reserves, ensuring that the company’s funds adequately back all user assets.

ISO/IEC 27001 Certification: A Testament to Security Standards

Woo Network has achieved certification to ISO/IEC 27001, a globally recognized standard for information security management. This certification reflects Woo Network’s commitment to maintaining the highest security standards, providing users with assurance about the safety of their investments.

Active Bug Bounty Program

An active bug bounty program is another significant aspect of Woo Network’s security infrastructure. This program encourages the community to identify and report potential vulnerabilities in the platform’s web applications and API, fostering a collaborative approach to maintaining security.

Customer Support: Avenues and Responsiveness

While Woo Network’s customer support services have been noted as needing improvement, the platform offers support through a dedicated support center. However, there is room for more efficient and responsive customer service, including additional methods of contact such as telephone, text, or live chat.

Educational Resources and Guides

In addition to technical support, Woo Network provides a comprehensive range of educational resources and guides. These resources are designed to assist users in navigating the platform and understanding the intricacies of cryptocurrency trading, further enhancing the user experience on the platform.

Chapter 9: Global Reach and Restrictions of Woo Network

Woo Network’s Global Footprint

Woo Network has established itself as a global player in the cryptocurrency exchange market, offering its services to a wide international audience. The network’s reach extends across multiple continents, providing traders and investors around the world with access to its comprehensive suite of trading tools and features.

Understanding Geographical Limitations

Despite its global presence, Woo Network faces certain geographical restrictions. Notably, the platform is not available to residents of the United States or to U.S. persons. This restriction is in compliance with the regulatory frameworks governing cryptocurrency trading in different jurisdictions. The network also outlines other restricted jurisdictions on its website, emphasizing its commitment to adhering to local laws and regulations.

Navigating Regulatory Landscapes

The dynamic nature of cryptocurrency regulation across various countries poses a challenge for platforms like Woo Network. The platform’s approach to these regulatory landscapes is cautious and compliant, ensuring that its operations do not contravene local laws. This compliance is crucial for maintaining the network’s reputation and trustworthiness among its users and regulatory bodies.

Chapter 10: Conclusion – Assessing Woo Network’s Place in the Crypto Market

Recap of Woo Network’s Features and Services

Woo Network has positioned itself as a versatile and robust platform in the cryptocurrency exchange market, offering a unique blend of centralized and decentralized finance services. The network’s collaboration with Kronos Research for liquidity aggregation, the zero-fee trading model on WOO X, and the innovative sPMM model in WOOFi are standout features that distinguish Woo Network from its competitors.

Strengths of Woo Network

- Diverse Trading Options: The platform offers a range of trading experiences, including spot and futures markets, catering to various trader profiles.

- Advanced Security Measures: With ISO/IEC 27001 certification and a proactive stance on security, Woo Network provides a secure trading environment.

- Educational Resources and Support: Despite areas for improvement in customer support, the platform’s extensive educational resources empower users with knowledge and skills for trading.

Areas for Growth

While Woo Network has made significant strides, there are areas for further development:

- Enhanced Customer Support: More responsive and varied customer support options could improve the overall user experience.

- Expansion into Restricted Markets: Navigating regulatory challenges to expand into markets like the United States could broaden the network’s user base.

Final Thoughts

In conclusion, Woo Network offers a comprehensive and sophisticated platform that serves a wide range of needs in the crypto trading and investment market. Its commitment to security, innovative trading solutions, and educational support make it a noteworthy choice for traders and investors. As the crypto market continues to evolve, Woo Network’s adaptability and expansion of services will be crucial in maintaining its competitive edge and satisfying the diverse needs of its global user base.

P.S. The above links are affiliate.

Leave a Reply