Fairdesk is a centralized cryptocurrency exchange, established and registered in Singapore. It offers a platform for traders to engage in both long and short trading, allowing them to profit from both rising and falling markets. The exchange provides leverage up to 125x and is known for its focus on copy trading features and lower costs.

Founded in 2021, Fairdesk was initiated by former employees of Binance and former software architects from Morgan Stanley. The platform primarily focuses on derivatives trading and offers features like spot and futures trading for over 55 coins. Additionally, it provides services like earn accounts.

I have a VIP referral code to Fairdesk that you can use to get additional bonus here.

How to Copy Trade on Fairdesk

Copy Trading is one of the main features of Fairdesk.

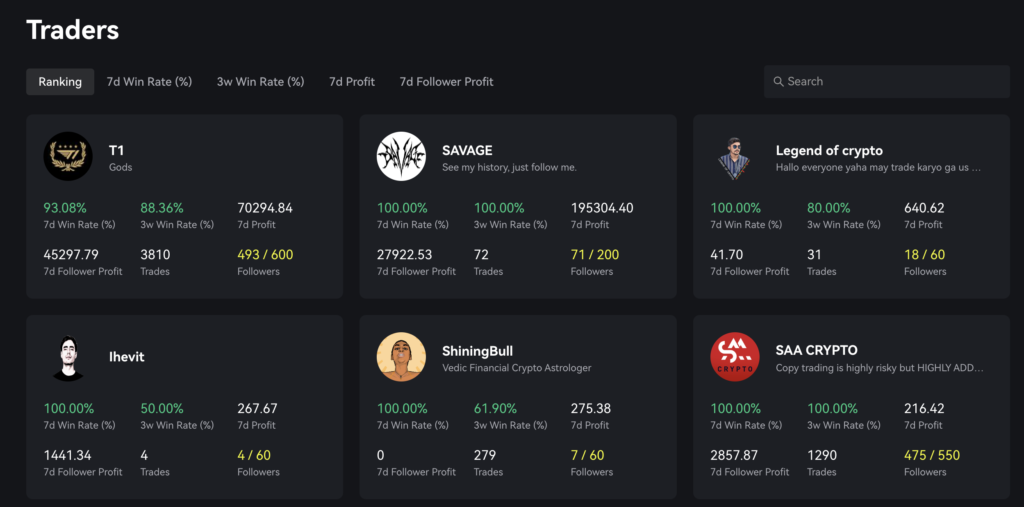

Copy trading is a feature that allows traders to automatically copy the trades of experienced and successful traders (of course remember that no profits are ever guaranteed and past profits do not indicate future results – crypto is risky, always do your own research). The screenshot shows a list of traders with various statistics that can help in deciding whom to copy:

- 7d Win Rate: The percentage of winning trades in the last 7 days.

- 3w Win Rate: The percentage of winning trades in the last 3 weeks.

- 7d Profit: The total profit made by the trader in the last 7 days.

- 7d Follower Profit: The total profit made by followers copying the trader’s trades in the last 7 days.

- Trades: The total number of trades the trader has executed.

- Followers: The current number of followers against the maximum allowed.

To copy trade on Fairdesk:

- Choose a Trader: Based on the performance metrics, choose a trader whose strategy aligns with your risk tolerance.

- Set Parameters: Click on the “Copy” button next to their name and configure your copy trading parameters such as the amount to allocate, the copy ratio, stop loss, etc.

- Monitor and Adjust: Once you start copying, monitor the performance and adjust your settings as needed.

This approach enables users to leverage the expertise of seasoned traders without actively managing every trade themselves.

Fairdesk allows you to click on each trader individually and see performance of each trader in detail together with positions opened and closed.

How to Buy Crypto with Visa/Mastercard

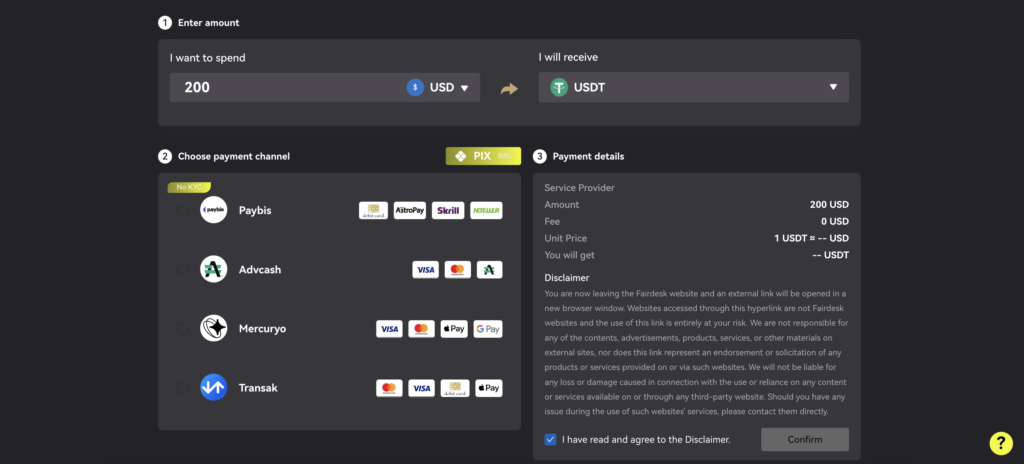

Fairdesk works with various fiat-to-crypto vendors and supports buying crypto through credit cards, Google Pay, and Apple Pay via Mercuryo. More fiat vendors are expected to collaborate with Fairdesk in the future to simplify the purchasing process.

Simply click on Buy Crypto on top and you will be able to pay for a stablecoin USDT (in principle should be 1:1 to USD) or BTC or ETH.

How to Trade Futures on Fairdesk

Fairdesk Derivatives offers a substantial number of trading pairs. Specifically, there are 173 trading pairs available on the exchange. Regarding its trading volume, Fairdesk Derivatives has reported a significant 24-hour trading volume of approximately $1.804 billion, which marks a notable change of 107.51% compared to the previous day.

To start, use my VIP referral code to Fairdesk.

- What are Futures Contracts: Futures contracts are agreements to buy or sell an asset at a later date at a set price. They are used for hedging and speculative purposes.

- Leverage in Futures Trading: Futures trading amplifies profit and loss through leverage. For example, with a 5% margin (or 20x leverage), a 2.5% market increase results in a 50% return, while a 2.5% decrease leads to a 50% loss.

- Trading on Exchanges: Futures trading takes place on exchanges, which enforce regulations, ensure order execution, risk management, and deliveries.

The basic principle involves selecting a futures contract, deciding on the position size, setting leverage, and then opening a long or short position based on your market analysis.

Fairdesk Futures trading allows a bunch of different features that you can customize:

- Margin Mode: There are two types of margin modes, “Isolated” and “Cross”. Isolated Margin means that the margin placed for a position is isolated from the trader’s main account balance and any losses can only go up to the isolated margin amount. Cross Margin, not shown in the screenshot but implied by the presence of Isolated, uses all available balances to prevent liquidation.

- Leverage: Fairdesk allows leverage up to 125x, which significantly increases both the potential profit and risk.

- Market vs Limit Orders: The default tab selected is “Market”, which means the order will be executed immediately at the best available current market price. A “Limit” order, would be executed only when the market reaches the price specified by the trader.

- Buy/Long vs Sell/Short: The green “Buy/Long” button is for entering a position betting the price will go up. The red “Sell/Short” button is for entering a position betting the price will go down.

- Available Balance: Shows the amount of USDT available to open new positions.

This interface allows traders to quickly switch between different types of orders and adjust their trading strategy based on their risk tolerance and market view.

Fairdesk savings

Apart from copy trading, futures, buying on spot, Fairdesk also allows you to earn through savings products. You can get 4%-5% on your BTC or ETH, as well as other major coins by simply staking them on the platform.

Fairdesk tutorial

If you’re looking for a full crypto trading tutorial on Fairdesk exchange, check out this comprehensive tutorial:

Finally remember crypto is risky.

Nothing here is financial advice. The content is purely for educational purposes.

Leave a Reply