Lyra Finance is a decentralized trading platform offering both crypto futures and crypto options. This allows for unique trading strategies like covered calls. With Lyra Launch Season playing delta neutral strategies not only can make you money but also earn you additional LYRA token rewards.

Use our special referral link to gain additional points in Lyra Finance Campaign.

What is the Lyra Launch Season?

Lyra Launch Season is a strategic initiative that allows traders to earn substantial LYRA rewards by simply engaging in trading activities on the Lyra platform. This season is remarkable for its sheer scale: a whopping 150,000,000 LYRA tokens are allocated for distribution over a span of 96 weeks, based on the trading activities of participants. The magnitude of rewards has left many traders in disbelief, prompting a flurry of incredulous queries on social media platforms like Twitter.

Why Participate in the Lyra Launch Season?

- Generous Rewards: The primary allure of the Lyra Launch Season is the generous LYRA rewards that traders can earn. This is a unique opportunity to augment your earnings significantly.

- Real-Time Earnings Update: Lyra provides each trader with a dedicated rewards page, where they can see their earnings getting updated in real time. This transparency ensures that traders are always aware of their reward standings.

- Limited Time Opportunity: As the saying goes, “Strike while the iron is hot.” The Lyra Launch Season is a time-sensitive opportunity. As more traders join in, the competition will inevitably increase, possibly eroding the current lucrative reward structure.

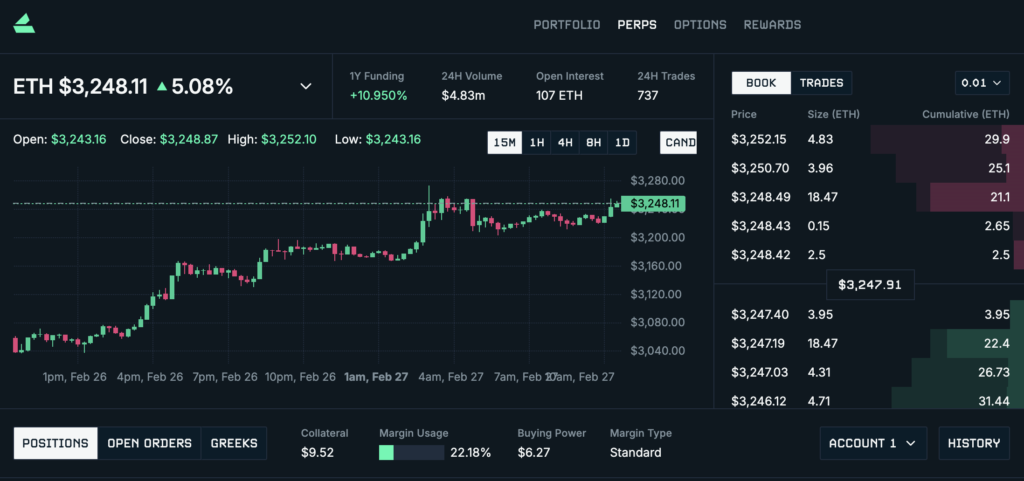

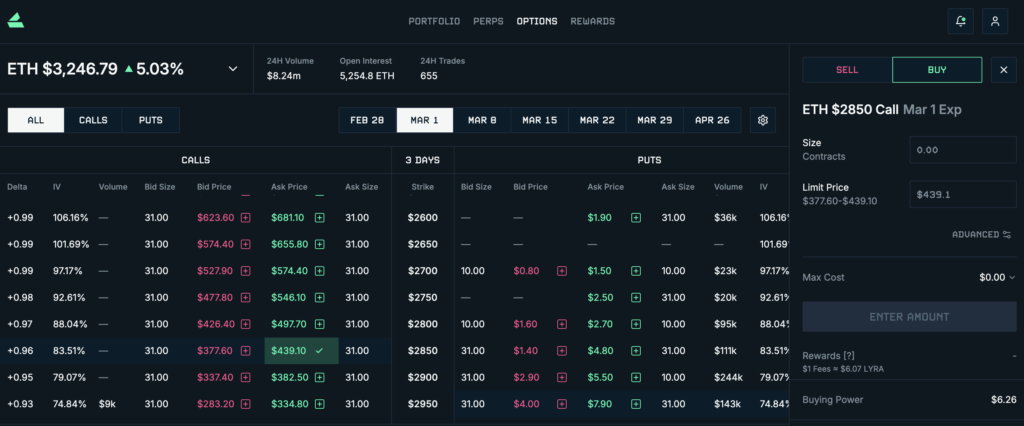

How to Farm LYRA Rewards

Earning rewards in the Lyra Launch Season is straightforward: trade options and perpetuals (perps) on Lyra. Interestingly, trading options yield more rewards compared to perps. The platform offers a plethora of strategies for traders to employ, catering to various market outlooks and risk appetites. We’re going to give you some ideas below (nothing here is financial advice, always do your research!).

Crypto Options Explained

A call option is a financial contract that gives the buyer the right, but not the obligation, to buy an asset like Ethereum (ETH) at a predetermined price (known as the strike price) before a specified date (the expiry date). For instance, if you buy a call option for Ethereum with a strike price of $3,100 and an expiry one month away, you are betting that ETH’s price will rise above $3,100 before the option expires. If it does, you can purchase ETH at $3,100, regardless of the higher market price.

Conversely, a put option gives the buyer the right to sell ETH at the strike price before the expiry. If you buy a put option with a strike price of $2,900, you’re anticipating that Ethereum’s price will fall below this level before the option’s expiration. If your prediction is correct, you can sell ETH at the higher strike price, even if its market value has declined. Both types of options are ways traders can leverage their market predictions, either bullish or bearish, while potentially limiting their losses to the premium paid for these options.

🐂 Bullish Farming Strategies

For those optimistic about the future price of Bitcoin (BTC) or Ethereum (ETH), there are several strategies to consider:

Long Call: This classic bullish strategy involves buying call options, betting on the price of the underlying asset to rise.

Example of Long Call: Assume Ethereum is trading at $3,000. Anticipating a price increase, you buy a call option with a strike price of $3,100 that expires in one month. If Ethereum’s price climbs above $3,100 before the option expires, you can exercise the option to buy Ethereum at $3,100, potentially selling it at a higher market price.

Bullish Call Spread: This strategy involves buying a call option while simultaneously selling another call option with a higher strike price. It’s a way to benefit from a price rise while managing risk.

Example of Bullish Call Spread: With Ethereum at $3,000, you implement a bullish call spread by buying a call option with a strike price of $3,100 and simultaneously selling another call option with a strike price of $3,200, both expiring in the same month. If Ethereum’s price rises and settles between $3,100 and $3,200, you can profit from the difference between these strike prices, minus the costs associated with the options.

🦀 Neutral Farming Strategies

If you prefer a less volatile approach and wish to minimize exposure to the price movements of BTC or ETH, consider:

Covered Calls: This strategy involves holding the underlying asset while selling call options on it. It’s a way to earn premium income while holding the asset.

Example of Covered Calls: You currently hold Ethereum, which is valued at $3,000. To generate additional income, you decide to sell a call option with a strike price of $3,100. If Ethereum’s price remains below $3,100 until the option’s expiration, the option will expire worthless, allowing you to keep the premium from selling the option and your ETH holdings.

🐻 Bearish Farming Strategies

For those who anticipate a decline in the price of BTC or ETH, the following strategies could be effective:

Long Put: Similar to a long call, but in reverse. Here, you buy put options betting on the price of the underlying asset to fall.

Example of Long Put: Believing that Ethereum’s price will decline from its current level of $3,000, you buy a put option with a strike price of $2,900, expiring in a month. If the price of Ethereum falls below $2,900 before the option expires, you can exercise the option to sell Ethereum at the strike price of $2,900, potentially above the market price.

Bearish Put Spread: This involves buying a put option and selling another put option with a lower strike price, allowing you to profit from a price decline while managing risk.

Example of Bearish Put Spread: Ethereum is at $3,000, and you foresee a moderate price drop. You buy a put option with a strike price of $2,900 and sell another put option with a strike price of $2,800, both expiring in the same month. If Ethereum’s price drops between these strike prices, your profit is the spread between the $2,900 and $2,800 strike prices, minus the costs of the options.

These strategies, tailored to the current price of Ethereum, offer a spectrum of approaches depending on your market outlook and risk tolerance. It’s important to understand each strategy thoroughly and assess your financial goals and risk profile before participating in options trading.

Conclusion

The Lyra Launch Season presents an extraordinary opportunity for traders to enhance their earnings through strategic trading. Whether you are bullish, neutral, or bearish about the future of cryptocurrencies like BTC or ETH, the Lyra platform offers a strategy to suit your outlook. Remember, opportunities like this don’t last forever. It’s time to dive in and make the most of the Lyra Launch Season!

P.S. Nothing here is financial advice. Crypto is risky. The above links are affiliate.

Leave a Reply