Vertex Protocol is an all-in-one decentralized exchange (DEX) that emphasizes trade, earning, and borrowing capabilities. It is designed with a turbo-charged trading engine meant to outperform competitors, and operates without Maximum Extractable Value (MEV) issues. Built on Arbitrum, it aims to optimize performance for all users.

It’s currently the number one decentralized crypto exchange with perpetuals by volume.

Trade on Vertex with our referral link and get 10% off.

Key Features of Vertex

Vertex is currently the one one

- Universal Margin Account: Vertex provides a single trading account where margin can be shared across all positions and assets, enhancing flexibility and efficiency. Your portfolio essentially serves as your margin.

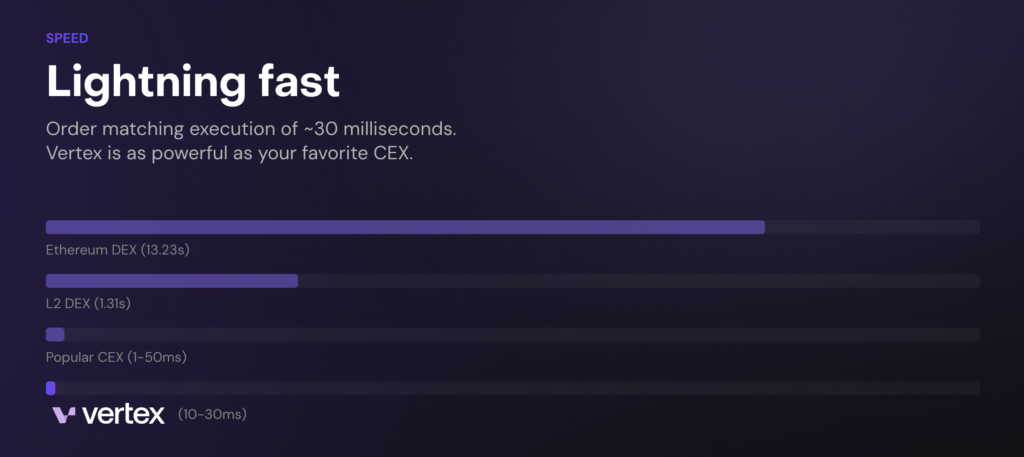

- Speed: Vertex boasts a lightning-fast order matching execution time of approximately 30 milliseconds, significantly faster than typical Ethereum DEX and some Layer 2 DEXs.

- Interface: The platform offers a customizable and intuitive trading experience, with features like custom notifications, unique trading console layouts, risk management signals, and one-click trading. There’s also a mobile version for trading on the go.

- Portfolio Management: Users can manage all their positions through an elegant interface, with various account indicators to simplify trading and risk management.

- Earning Interest: By depositing assets into Vertex, users enable other traders to borrow these assets, earning interest in the process. This is secured through over-collateralized smart contracts.

- Safety and Security: Built on Arbitrum, an Ethereum Layer 2 solution, Vertex offers enhanced transaction speed and lower fees while maintaining Ethereum’s security level.

- Trade & Earn: Users can trade on Vertex and earn $VRTX, the platform’s native token.

Investors and Partners: Vertex has attracted support from industry-leading market makers and venture capital firms, including Wintermule, Dexterity Capital, Hack VC, and others.

Community and Support: Vertex actively engages with its community through channels like Discord, YouTube, and Twitter, and offers detailed documentation for both users and developers.

How to start trading on Vertex

Signing up and trading on Vertex Protocol involves several steps.

First of all, you can use our referral link to get 10% off trading fees and additional bonuses.

Here’s a general guide on how to get started:

- Create a Cryptocurrency Wallet: Before you can interact with Vertex Protocol, you need a cryptocurrency wallet compatible with Arbitrum, like MetaMask. This wallet will be used to connect to the Vertex Protocol.

- Funding Your Wallet: You need to have funds on your Metamask wallet. You can deposit it there from a centralized exchange like MEXC, or buy directly in Metamask with a card.

- Connecting to Vertex Protocol: Once your wallet is funded and set up for the Arbitrum network, you can connect it to the Vertex Protocol platform. This is done by navigating to the platform’s website and selecting the “Connect Wallet” option.

- Depositing Funds: To trade, you need to deposit funds into your Vertex account. This can be done through the platform’s interface, where you’ll select the amount and type of cryptocurrency to deposit. The platform prefers USDC.e – a version of USDC that you can easily get on Uniswap. You’ll be automatically redirected from Vertex website.

- Trading: Vertex offers spot trading, where you can buy and sell actual assets as opposed to derivatives. To trade:

- Select the market you want to trade in.

- Decide if you want to trade with or without leverage.

- Choose between a limit order (where you set the price at which you want to buy or sell) or a market order (where the trade executes immediately at the current market price).

- Enter the details of your trade, like the size and price (for limit orders).

- Place your trade and confirm the transaction in your wallet.

- Managing Your Trades: You can manage your open orders and positions through the platform’s interface. This includes cancelling open limit orders and tracking your portfolio.

Remember, trading on decentralized exchanges like Vertex Protocol involves risks, and it’s important to understand these before getting started. For a detailed guide on using Vertex Protocol, including the specifics of trade execution and portfolio management, you can refer to their official documentation at Vertex Docs

Vertex Protocol in 2023 and 2024

Vertex Protocol has been making significant strides in the decentralized finance (DeFi) sector, especially in 2023. As a decentralized exchange (DEX) on Arbitrum, it has introduced several innovative features and has been experiencing substantial growth in its operations.

Token Launch and Unique Features

One of the most noteworthy developments for Vertex Protocol in 2023 was the launch of its highly anticipated token, VRTX. The platform stands out in the crowded DEX arena by offering universal cross-margin accounts and combining spot, perpetuals, and money markets into a single platform. This integration is a first in the DEX space, providing low fees and capital efficiency in decentralized trading. Additionally, Vertex has addressed the issue of miner extractable value (MEV) risks by taking order matching off-chain, making it impossible for validators to exploit transaction orders. Another significant feature is its ultra-fast order execution, with an approximate speed of 30 milliseconds, competitive with centralized exchanges.

Liquidity Bootstrapping Auction

Vertex adopted a novel approach for its token distribution with the VRTX Liquidity Bootstrapping Auction (LBA). This event, which took place from November 13 to November 20, 2023, used two liquidity pools to facilitate initial VRTX price discovery. This mechanism was designed to extend the price discovery period and allow liquidity providers to dynamically manage their contributions, deviating from standard pool-based launches.

Trading Volume and TVL Growth

Vertex Protocol has seen an increase in trading volumes for spot and perpetual markets, with a significant rise in its token price. Over a short period, the VRTX price surged by 33%, hitting $0.44, and the total value locked (TVL) in the protocol reached $32 million. This growth has been partly fueled by incentives provided to users, such as the Arbitrum (ARB) incentives program and rewards from the Trade & Earn program.

Vertex Market Position

The platform’s innovative approach and features have positioned it as a competitive force in the DeFi space. Its integration of various market types under one unified interface and focus on low fees and high-speed transactions are notable factors contributing to its growth and popularity.

In conclusion, Vertex Protocol is not just another DEX in the market. Its innovative features, such as the integration of different market types, fast transaction speeds, and unique token launch strategies, set new standards in the DeFi space and make it a noteworthy player to watch in the future.

Finally you watch a video review of Vertex Protocol here:

P.S. the above links are affiliate.

Leave a Reply