The much-anticipated Eigenlayer airdrop promises significant rewards for those who prepare strategically. Eigenlayer, a middleware on Ethereum, allows you to re-stake your Ethereum (ETH) or staked ETH tokens for additional profit and amplified airdrop point accrual. This guide explores proven tactics to boost your Eigenlayer points, leading to potentially increased airdrop benefits.

You can buy Ethereum ETH on top exchanges like MEXC, Gate.io and KuCoin using our VIP referral links with additional bonuses.

The Basics: Building Your Foundation

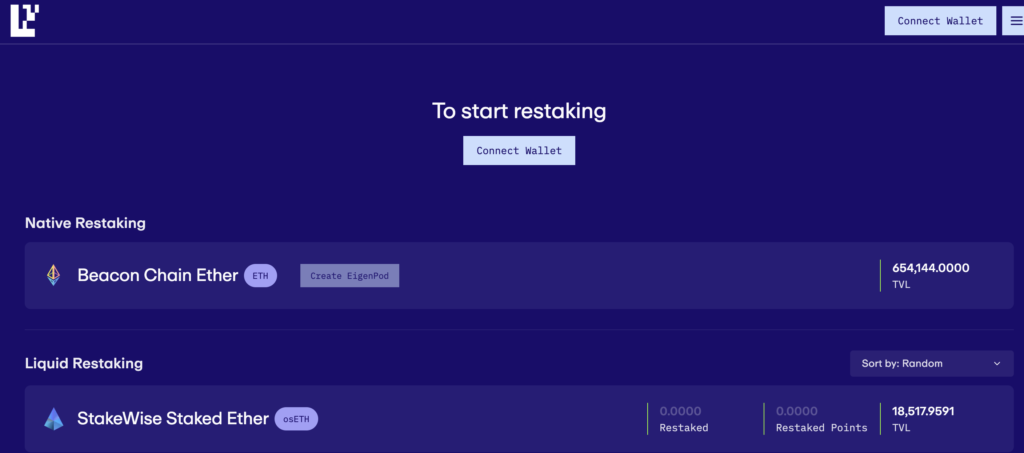

- Direct Re-staking with Eigenlayer: Stake your ETH directly with Eigenlayer validators for efficiency and strong point earning.

- Liquid Staking Protocols (LSDs): Platforms like Lido Finance, Coinbase, Rocket Pool, and Swell Network issue liquid staking derivatives (e.g., stETH, cbETH, rETH), representing your staked ETH. These tokens unlock greater flexibility and opportunities within DeFi protocols.

Strategies for Success

- Maximize Your Staked ETH: The higher the amount of ETH re-staked, the larger the potential airdrop gain. Prioritize accumulating staked ETH wherever possible.

- Choose Your LSD Wisely:

- Eigenlayer Rewards: Ensure your desired LSD actively participates in Eigenlayer and offers boosted airdrop points related to their derivative token.

- DeFi Compatibility: Not all LSD tokens are equally supported across DeFi platforms. Research if there are specific pairings and yield enhancement protocols for your preferred liquid staking provider.

- Staking Yields: Yields may slightly differ between LSDs. Factor in their baseline APY alongside potential DeFi earnings when comparing options.

Token-Specific Techniques

- stETH (Lido): Frequently features special promotions and increased point multipliers on Eigenlayer, alongside strong DeFi support across platforms like Pendle.

- cbETH (Coinbase): Consider holding some cbETH as part of a diversification strategy.

- rETH (Rocketpool): Another popular token for a diversified LSD basket.

- swETH (Swell Network): Offers unique flexibility for users looking to manage risks, but DeFi compatibility may be more limited currently. Also a potential Swell Airdrop might be coming too!

- Multi-Token Diversification: Holding several LSDs instead of a single one spreads your exposure and may allow you to capture benefits targeted at a broader range of tokens. Remember to factor in transaction costs and manage the potentially increased complexity of this approach.

Boosting Your Points Further

- DeFi Yield Enhancement: Explore platforms like Pendle, and Eigenpie (further research recommended) to potentially earn extra yields and Eigenlayer point multipliers on your held LSDs. Also Magpie is interesting and might provide an airdrop of its own.

- Early Participation Matters: Depending on when you re-stake, point multipliers may be available from Eigenlayer. Participate sooner rather than later, if possible.

Important Reminders

- Transaction Fees: Each transaction on Ethereum incurs gas fees. Strategize and execute token moves when gas prices are lower to minimize costs.

- Smart Contract Risks: Layering DeFi protocols adds new smart contract vulnerabilities. Thoroughly research platforms for their reputation and audit history before investing.

Quick tips on EigenLayer Airdrop

Read more in this thread:

Watch the video version of this:

Disclaimer: Information in this blog is not financial advice. Prioritize independent research before any investment decision. Above links are affiliate.

Leave a Reply